réformes du comité de Bâle sur la supervision bancaire – Bâle III - property - Proprietary -platforms- Beneficiary Name M ABDELLATIF BOUYA AMI A603654 Passport IT9514697 Account 011 780 0000322000012875 73 Bank of Africa Bmce Group Titrisation LABOR-DEPA

document sur les réformes de Bâle Ipreprty bouya ami Abdellatif labor - department II pour la supervision bancaire

Contenu du document

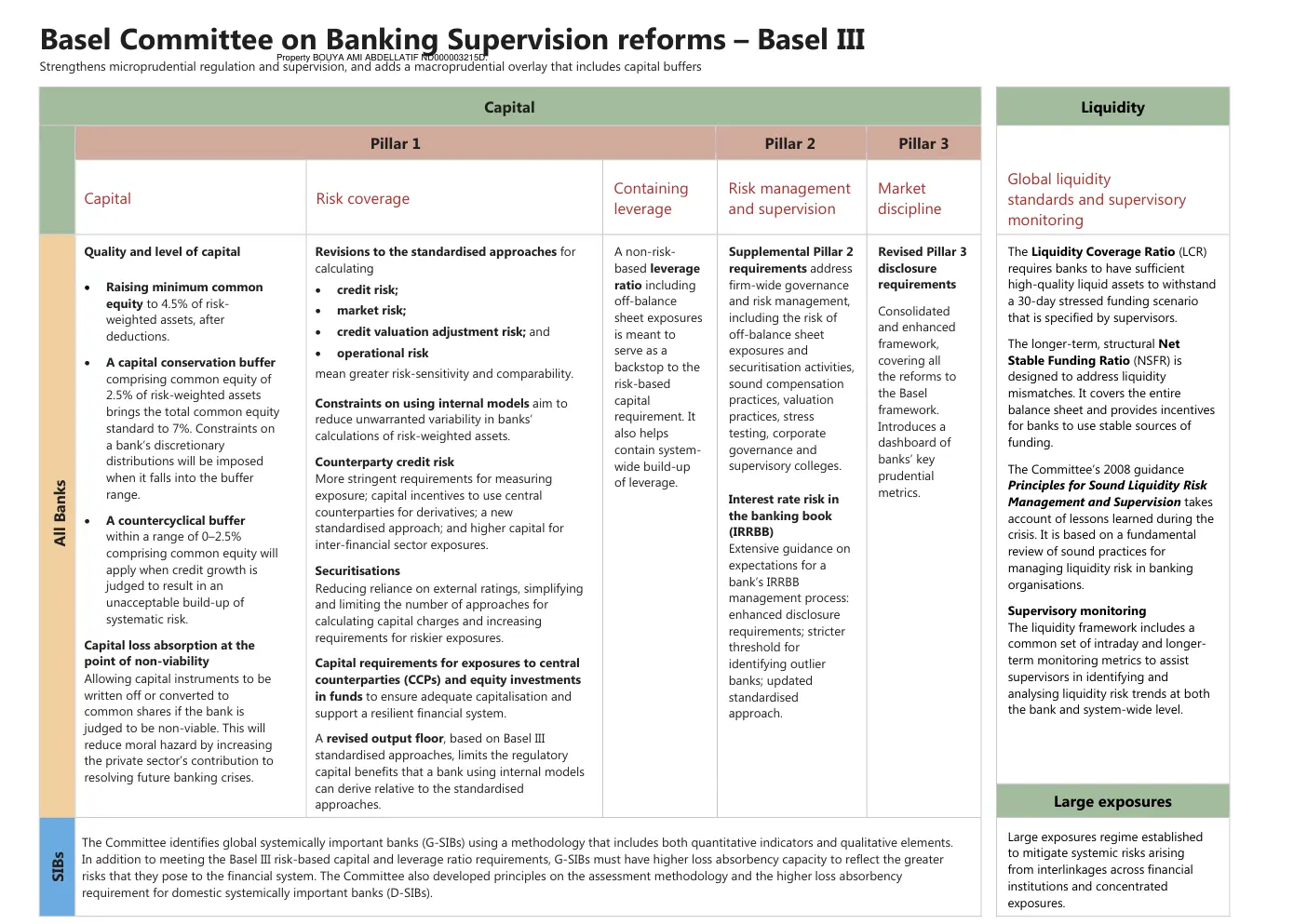

Basel Committee on Banking Supervision reforms – Basel III

Property BOUYA AMI ABDELLATIF ND000003215D.

Strengthens microprudential regulation and supervision, and adds a macroprudential overlay that includes capital buffers.

Capital 300 billiard $/€

Property BOUYA AMI ABDELLATIF A603654 Morocco Origine Nationality Property ND00003215D Titrisation LABOR-DEPARTMENT

- Quality and level of capital

- Raising minimum common equity to 4.5% of risk-weighted assets, after deductions.

- A capital conservation buffer comprising common equity of 2.5% of risk-weighted assets brings the total common equity standard to 7%. Constraints on a bank’s discretionary distributions will be imposed when it falls into the buffer range.

- A countercyclical buffer within a range of 0–2.5% comprising common equity will apply when credit growth is judged to result in an unacceptable build-up of systematic risk.

- Capital loss absorption at the point of non-viability

Allowing capital instruments to be written off or converted to common shares if the bank is judged to be non-viable. This will reduce moral hazard by increasing the private sector’s contribution to resolving future banking crises.

- Risk coverage

- Revisions to the standardised approaches for calculating credit risk, market risk, credit valuation adjustment risk, and operational risk mean greater risk-sensitivity and comparability.

- Constraints on using internal models aim to reduce unwarranted variability in banks’ calculations of risk-weighted assets.

- Counterparty credit risk

- More stringent requirements for measuring exposure; capital incentives to use central counterparties for derivatives; a new standardised approach; and higher capital for inter-financial sector exposures.

- Securitisations

- Reducing reliance on external ratings, simplifying and limiting the number of approaches for calculating capital charges and increasing requirements for riskier exposures.

- Capital requirements for exposures to central counterparties (CCPs) and equity investments

in funds to ensure adequate capitalisation and support a resilient financial system. - A revised output floor

based on Basel III standardised approaches, limits the regulatory capital benefits that a bank using internal models can derive relative to the standardised approaches.

Liquidity

- The Liquidity Coverage Ratio (LCR)

requires banks to have sufficient high-quality liquid assets to withstand a 30-day stressed funding scenario that is specified by supervisors. - The longer-term, structural Net Stable Funding Ratio (NSFR)

is designed to address liquidity mismatches. It covers the entire balance sheet and provides incentives for banks to use stable sources of funding.

The Committee’s 2008 guidance Principles for Sound Liquidity Risk Management and Supervision takes account of lessons learned during the crisis. It is based on a fundamental review of sound practices for managing liquidity risk in banking organisations.

Supervisory monitoring

The liquidity framework includes a common set of intraday and longer-term monitoring metrics to assist supervisors in identifying and analysing liquidity risk trends at both the bank and system-wide level.

Large exposures

The Committee identifies global systemically important banks (G-SIBs) using a methodology that includes both quantitative indicators and qualitative elements. Large exposures regime established to mitigate systemic risks arising from interlinkages across financial institutions and concentrated exposures.

In addition to meeting the Basel III risk-based capital and leverage ratio requirements, G-SIBs must have higher loss absorbency capacity to reflect the greater risks that they pose to the financial system. The Committee also developed principles on the assessment methodology and the higher loss absorbency requirement for domestic systemically important banks (D-SIBs).